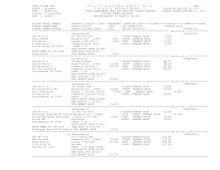

STATE OF NEW YORK

2 0 1 6 F I N A L A S S E S S M E N T R O L L

PAGE 624

COUNTY - Delaware

T A X A B L E SECTION OF THE ROLL - 1

VALUATION DATE-JUL 01, 2015

TOWN - Middletown

TAXABLE STATUS DATE-MAR 01, 2016

SWIS - 124689

TAX MAP NUMBER SEQUENCE

UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL

CURRENT OWNERS NAME SCHOOL DISTRICT

LAND TAX DESCRIPTION

TAXABLE VALUE

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS

ACCOUNT NO.

******************************************************************************************************* 287.-1-2.34 ****************

114 Oak Ridge Rd

07848568201

287.-1-2.34

210 1 Family Res

ELG VET C 41102 0

300 0

0

Hynes Mary A

Margaretville 124601 63,500 VET WAR T 41123 0

0 12,000

0

Hynes Charles E

Armstrong T Gl#8 L-26 258,200 STAR BASIC 41854 0

0 0 30,000

PO Box 834

Finch

COUNTY TAXABLE VALUE

257,900

Fleischmanns, NY 12430 ACRES 6.35

TOWN TAXABLE VALUE

246,200

EAST-0485787 NRTH-1215877 SCHOOL TAXABLE VALUE

228,200

DEED BOOK 909 PG-346

FD123 Middletown fd #1

258,200 TO

FULL MARKET VALUE

258,200

******************************************************************************************************* 287.-1-2.35 ****************

Streeter Hill Rd

07848578201

287.-1-2.35

314 Rural vac<10

COUNTY TAXABLE VALUE

26,600

Delgado Antonio Jr Margaretville 124601 26,600 TOWN TAXABLE VALUE

26,600

220-55 46th Ave Apt 7V Armstrong T Gl#8 L-26 26,600 SCHOOL TAXABLE VALUE

26,600

Bayside, NY 11361 Schiller

FD123 Middletown fd #1

26,600 TO

ACRES 3.65

EAST-0486160 NRTH-1216177

DEED BOOK 731 PG-1010

FULL MARKET VALUE

26,600

******************************************************************************************************* 287.-1-2.36 ****************

356 Oak Ridge Rd

07849718201

287.-1-2.36

210 1 Family Res

COUNTY TAXABLE VALUE

198,600

Almanza Norma

Margaretville 124601 47,100 TOWN TAXABLE VALUE

198,600

Rojas Eurice

Armstrong Gl#8 L-26 198,600 SCHOOL TAXABLE VALUE

198,600

441 Oncrest Terr

Thorbjarnarson

FD123 Middletown fd #1

198,600 TO

Cliffside Park, NJ 07010 ACRES 5.30

EAST-0485105 NRTH-1216073

DEED BOOK 979 PG-215

FULL MARKET VALUE

198,600

******************************************************************************************************* 287.-1-2.37 ****************

261 Oak Ridge Rd

07849728201

287.-1-2.37

210 1 Family Res

COUNTY TAXABLE VALUE

251,800

March Misty

Margaretville 124601 58,000 TOWN TAXABLE VALUE

251,800

474 3rd St Apt 4L Armstrong Gl#8 L-26 251,800 SCHOOL TAXABLE VALUE

251,800

Brooklyn, NY 11215 Champion

FD123 Middletown fd #1

251,800 TO

ACRES 5.78

EAST-0485151 NRTH-1215347

DEED BOOK 1359 PG-192

FULL MARKET VALUE

251,800

******************************************************************************************************* 287.-1-2.38 ****************

264 Oak Ridge Rd

07849738201

287.-1-2.38

210 1 Family Res

COUNTY TAXABLE VALUE

203,900

Manzari Bonnie L

Margaretville 124601 56,200 TOWN TAXABLE VALUE

203,900

825 W 187th St Apt 5F Armstrong Gl#8 L-26 203,900 SCHOOL TAXABLE VALUE

203,900

New York, NY 10033 Manzari

FD123 Middletown fd #1

203,900 TO

ACRES 5.28

EAST-0485427 NRTH-1215848

DEED BOOK 1432 PG-347

FULL MARKET VALUE

203,900

************************************************************************************************************************************