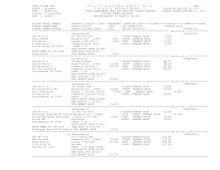

STATE OF NEW YORK

2 0 1 6 F I N A L A S S E S S M E N T R O L L

PAGE 620

COUNTY - Delaware

T A X A B L E SECTION OF THE ROLL - 1

VALUATION DATE-JUL 01, 2015

TOWN - Middletown

TAXABLE STATUS DATE-MAR 01, 2016

SWIS - 124689

TAX MAP NUMBER SEQUENCE

UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL

CURRENT OWNERS NAME SCHOOL DISTRICT

LAND TAX DESCRIPTION

TAXABLE VALUE

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS

ACCOUNT NO.

******************************************************************************************************* 286.16-1-8 *****************

Off Old Route 28

07811837901

286.16-1-8

314 Rural vac<10

COUNTY TAXABLE VALUE

13,300

Pascarella Todd

Margaretville 124601 13,300 TOWN TAXABLE VALUE

13,300

Pascarella Jeanine Armstrong T Gl#8

13,300 SCHOOL TAXABLE VALUE

13,300

PO Box 103

Bourdon

FD123 Middletown fd #1

13,300 TO

Fleischmanns, NY 12430 ACRES 3.70 BANK 4333

EAST-0481347 NRTH-1211403

DEED BOOK 1141 PG-39

FULL MARKET VALUE

13,300

******************************************************************************************************* 286.16-1-9 *****************

120 Grocholl Rd

07800747001

286.16-1-9

210 1 Family Res

STAR BASIC 41854 0

0 0 30,000

Merwin Vincent C

Margaretville 124601 31,600 COUNTY TAXABLE VALUE

155,900

Merwin Joan N

Armstrong T Gl#8

155,900 TOWN TAXABLE VALUE

155,900

120 Grocholl Rd

Grocholl

SCHOOL TAXABLE VALUE

125,900

Fleischmanns, NY 12430 ACRES 2.90

FD123 Middletown fd #1

155,900 TO

EAST-0479370 NRTH-1211406

DEED BOOK 892 PG-91

FULL MARKET VALUE

155,900

******************************************************************************************************* 286.16-1-10 ****************

258 Kissimmee Rd

07801795001

286.16-1-10

210 1 Family Res

COUNTY TAXABLE VALUE

119,900

Solomon Steven I

Margaretville 124601 29,600 TOWN TAXABLE VALUE

119,900

Solomon Lee

Armstrong T Gl#8

119,900 SCHOOL TAXABLE VALUE

119,900

100 W Broadway Ste 7K Solomon

FD123 Middletown fd #1

119,900 TO

Long Beach, NY 11561 ACRES 2.40

EAST-0479092 NRTH-1211628

DEED BOOK 1352 PG-28

FULL MARKET VALUE

119,900

******************************************************************************************************* 286.16-1-11 ****************

160 Kissimmee Rd

07800386001

286.16-1-11

283 Res w/Comuse

STAR BASIC 41854 0

0 0 30,000

Blish John

Margaretville 124601 55,600 COUNTY TAXABLE VALUE

224,000

160 Kissimmee Rd

Armstrong T Gl#8

224,000 TOWN TAXABLE VALUE

224,000

Fleischmanns, NY 12430 Decastro

SCHOOL TAXABLE VALUE

194,000

ACRES 4.40

FD123 Middletown fd #1

224,000 TO

EAST-0478813 NRTH-1211417

DEED BOOK 692 PG-705

FULL MARKET VALUE

224,000

******************************************************************************************************* 286.16-1-16 ****************

128 Kissimmee Rd

07800249001

286.16-1-16

210 1 Family Res

COUNTY TAXABLE VALUE

155,600

JAP BLISH INC

Margaretville 124601 22,600 TOWN TAXABLE VALUE

155,600

160 Kissimmee Rd

Armstrong T Gl#8

155,600 SCHOOL TAXABLE VALUE

155,600

Fleischmanns, NY 12430 Bruno

FD123 Middletown fd #1

155,600 TO

ACRES 1.10

EAST-0478465 NRTH-1211400

DEED BOOK 1412 PG-251

FULL MARKET VALUE

155,600

************************************************************************************************************************************