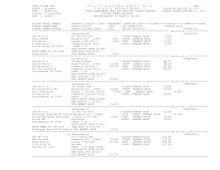

STATE OF NEW YORK

2 0 1 6 F I N A L A S S E S S M E N T R O L L

PAGE 596

COUNTY - Delaware

T A X A B L E SECTION OF THE ROLL - 1

VALUATION DATE-JUL 01, 2015

TOWN - Middletown

TAXABLE STATUS DATE-MAR 01, 2016

SWIS - 124689

TAX MAP NUMBER SEQUENCE

UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL

CURRENT OWNERS NAME SCHOOL DISTRICT

LAND TAX DESCRIPTION

TAXABLE VALUE

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS

ACCOUNT NO.

******************************************************************************************************* 286.-1-58.121 **************

Old Route 28

07800727001

286.-1-58.121

330 Vacant comm

COUNTY TAXABLE VALUE

147,300

HD Construction INC Margaretville 124601 147,300 TOWN TAXABLE VALUE

147,300

Attn: Herb Finch

Laussat Tract Fm #5522 147,300 SCHOOL TAXABLE VALUE

147,300

215 Hanley Rd

Crystal Brook Corp

FD123 Middletown fd #1

147,300 TO

Fleischmanns, NY 12430 ACRES 49.67

EAST-0474630 NRTH-1212527

DEED BOOK 736 PG-1113

FULL MARKET VALUE

147,300

******************************************************************************************************* 286.-1-58.21 ***************

86 Old Route 28

286.-1-58.21

210 1 Family Res

COUNTY TAXABLE VALUE

264,100

Hrazanek William

Margaretville 124601 32,600 TOWN TAXABLE VALUE

264,100

PO Box 43

Laussat Tract Fm#4008 264,100 SCHOOL TAXABLE VALUE

264,100

Fleischmanns, NY 12430 County Of Delaware

FD123 Middletown fd #1

264,100 TO

ACRES 3.14 BANK 45

EAST-0474538 NRTH-1211544

DEED BOOK 890 PG-307

FULL MARKET VALUE

264,100

******************************************************************************************************* 286.-1-58.22 ***************

Old Route 28

286.-1-58.22

314 Rural vac<10

COUNTY TAXABLE VALUE

26,600

Hrazanek William

Margaretville 124601 26,600 TOWN TAXABLE VALUE

26,600

PO Box 43

Laussat Tract Fm#4008 26,600 SCHOOL TAXABLE VALUE

26,600

Fleischmanns, NY 12430 County Of Delaware

FD123 Middletown fd #1

26,600 TO

ACRES 3.66 BANK 45

EAST-0474969 NRTH-1211678

DEED BOOK 890 PG-305

FULL MARKET VALUE

26,600

******************************************************************************************************* 286.-1-60.1 ****************

332 Kleis Rd Ext R

07801009001

286.-1-60.1

210 1 Family Res

COUNTY TAXABLE VALUE

306,700

Telese Stephanie

Margaretville 124601 43,800 TOWN TAXABLE VALUE

306,700

312 Tenth St

Laussat Gl#8

306,700 SCHOOL TAXABLE VALUE

306,700

Brooklyn, NY 11215 Rosenthal

FD123 Middletown fd #1

306,700 TO

ACRES 4.12

EAST-0473792 NRTH-1213223

DEED BOOK 1261 PG-274

FULL MARKET VALUE

306,700

******************************************************************************************************* 286.-1-60.2 ****************

238 Kleis Rd

07804087701

286.-1-60.2

210 1 Family Res

STAR BASIC 41854 0

0 0 30,000

Draghi William

Margaretville 124601 32,500 COUNTY TAXABLE VALUE

90,400

PO Box 683

Laussat Gl#8

90,400 TOWN TAXABLE VALUE

90,400

Fleischmanns, NY 12430 Draghi

SCHOOL TAXABLE VALUE

60,400

ACRES 3.12 BANK 45

FD123 Middletown fd #1

90,400 TO

EAST-0473765 NRTH-1212807

DEED BOOK 1247 PG-274

FULL MARKET VALUE

90,400

************************************************************************************************************************************