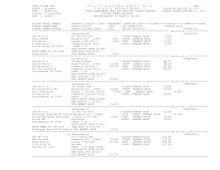

STATE OF NEW YORK

2 0 1 6 F I N A L A S S E S S M E N T R O L L

PAGE 595

COUNTY - Delaware

T A X A B L E SECTION OF THE ROLL - 1

VALUATION DATE-JUL 01, 2015

TOWN - Middletown

TAXABLE STATUS DATE-MAR 01, 2016

SWIS - 124689

TAX MAP NUMBER SEQUENCE

UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL

CURRENT OWNERS NAME SCHOOL DISTRICT

LAND TAX DESCRIPTION

TAXABLE VALUE

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS

ACCOUNT NO.

******************************************************************************************************* 286.-1-54 ******************

Off Toppi Rd

07801947001

286.-1-54

314 Rural vac<10

COUNTY TAXABLE VALUE

4,100

Hunter 66 LLC

Margaretville 124601 4,100 TOWN TAXABLE VALUE

4,100

Attn: Rocco Toppi Laussat Gl#8

4,100 SCHOOL TAXABLE VALUE

4,100

764 Peter Paul Dr Toppi

FD123 Middletown fd #1

4,100 TO

West Islip, NY 11795 FRNT 100.00 DPTH 150.00

EAST-0476310 NRTH-1211027

DEED BOOK 1158 PG-303

FULL MARKET VALUE

4,100

******************************************************************************************************* 286.-1-55 ******************

3 Toppi Rd

75 PCT OF VALUE USED FOR EXEMPTION PURPOSES

07800254001

286.-1-55

215 1 Fam Res w/

CW_15_VET/ 41163 0

0 12,000

0

Maxim Patricia D

Margaretville 124601 23,800 AGED T 41803 0

0 19,533

0

Maxim Robert L

Laussat Gl#8

126,500 AGED C/S 41805 0 37,950 0 37,950

PO Box 234

Caruso

STAR ENHAN 41834 0

0 0 65,300

Fleischmanns, NY 12430 ACRES 1.30

COUNTY TAXABLE VALUE

88,550

EAST-0476772 NRTH-1210526 TOWN TAXABLE VALUE

90,223

DEED BOOK 712 PG-83

SCHOOL TAXABLE VALUE

23,250

FULL MARKET VALUE

126,500 FD123 Middletown fd #1

126,500 TO

******************************************************************************************************* 286.-1-56.1 ****************

83 Toppi Rd

07800054001

286.-1-56.1

240 Rural res

COUNTY TAXABLE VALUE

272,800

Toppi Rocco

Margaretville 124601 189,300 TOWN TAXABLE VALUE

272,800

764 Peter Paul Dr Hunter 66 LLC

272,800 SCHOOL TAXABLE VALUE

272,800

West Islip, NY 11795 ACRES 73.80

FD123 Middletown fd #1

272,800 TO

EAST-0475428 NRTH-1209730

DEED BOOK 1190 PG-219

FULL MARKET VALUE

272,800

******************************************************************************************************* 286.-1-57 ******************

Toppi Rd

07800587001

286.-1-57

322 Rural vac>10

COUNTY TAXABLE VALUE

164,000

Hunter 66 LLC

Margaretville 124601 164,000 TOWN TAXABLE VALUE

164,000

Attn: Rocco Toppi Laussat Gl#8 Lot 77 164,000 SCHOOL TAXABLE VALUE

164,000

764 Peter Paul Dr Toppi

FD123 Middletown fd #1

164,000 TO

West Islip, NY 11795 ACRES 61.40

EAST-0474702 NRTH-1210467

DEED BOOK 1158 PG-303

FULL MARKET VALUE

164,000

******************************************************************************************************* 286.-1-58.11 ***************

Old Route 28

07800727001

286.-1-58.11

322 Rural vac>10

COUNTY TAXABLE VALUE

30,100

Liddle Daniel A

Margaretville 124601 30,100 TOWN TAXABLE VALUE

30,100

35321 State Hwy 10 County Of Delaware 30,100 SCHOOL TAXABLE VALUE

30,100

Hamden, NY 13782

ACRES 13.19

FD123 Middletown fd #1

30,100 TO

EAST-0475865 NRTH-1211673

DEED BOOK 778 PG-295

FULL MARKET VALUE

30,100

************************************************************************************************************************************