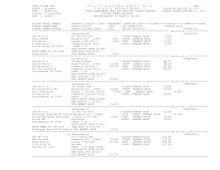

STATE OF NEW YORK

2 0 1 6 F I N A L A S S E S S M E N T R O L L

PAGE 363

COUNTY - Delaware

T A X A B L E SECTION OF THE ROLL - 1

VALUATION DATE-JUL 01, 2015

TOWN - Middletown

TAXABLE STATUS DATE-MAR 01, 2016

SWIS - 124689

TAX MAP NUMBER SEQUENCE

UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL

CURRENT OWNERS NAME SCHOOL DISTRICT

LAND TAX DESCRIPTION

TAXABLE VALUE

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS

ACCOUNT NO.

******************************************************************************************************* 243.-2-25 ******************

2285 County Hwy 36

243.-2-25

210 1 Family Res

CLERGY 41400 0 1,500 1,500 1,500

Walsh Esther H

Roxbury 124802 28,000 STAR ENHAN 41834 0

0 0 65,300

Walsh Rev Samuel Hayden Cartwright

137,400 COUNTY TAXABLE VALUE

135,900

2285 County Hwy 36 ACRES 2.01

TOWN TAXABLE VALUE

135,900

Margaretville, NY 12455 EAST-0471706 NRTH-1227844 SCHOOL TAXABLE VALUE

70,600

DEED BOOK 872 PG-338

FD122 Mdltwn-hrdbrgh fd

137,400 TO

FULL MARKET VALUE

137,400

******************************************************************************************************* 243.-2-26.1 ****************

315 Walker Rd

07800252026

243.-2-26.1

241 Rural res&ag

IND AG DST 41730 0 82,000 82,000 82,000

Cline William A

Roxbury 124802 142,300 STAR BASIC 41854 0

0 0 30,000

Cline Jill

3000 Ac Tr Lot D & 11 301,500 COUNTY TAXABLE VALUE

219,500

315 Walker Rd

Cline

TOWN TAXABLE VALUE

219,500

Margaretville, NY 12455 ACRES 39.13

SCHOOL TAXABLE VALUE

189,500

EAST-0471132 NRTH-1228451 FD122 Mdltwn-hrdbrgh fd

301,500 TO

MAY BE SUBJECT TO PAYMENT DEED BOOK 1313

PG-272

UNDER AGDIST LAW TIL 2023 FULL MARKET VALUE 301,500

******************************************************************************************************* 261.-2-1 *******************

Weaver Hollow Rd

261.-2-1

323 Vacant rural

FOREST480A 47460 0 3,200 3,200 3,200

Darwak John J

Margaretville 124601 4,000 COUNTY TAXABLE VALUE

800

Darwak Virginia M Darwak John J&r F Riseley 4,000 TOWN TAXABLE VALUE

800

PO Box 240

ACRES 1.10

SCHOOL TAXABLE VALUE

800

Shokan, NY 12481

EAST-0441119 NRTH-1222234 FD122 Mdltwn-hrdbrgh fd

4,000 TO

DEED BOOK 939 PG-159

MAY BE SUBJECT TO PAYMENT FULL MARKET VALUE 4,000

UNDER RPTL480A UNTIL 2025

******************************************************************************************************* 261.-3-1.111 ***************

County Hwy 6

07800339001

261.-3-1.111

322 Rural vac>10

COUNTY TAXABLE VALUE

145,000

City of New York

Margaretville 124601 145,000 TOWN TAXABLE VALUE

145,000

Bureau of Water Supply, Taxes Nkt Cl2-L7-8-9 Cl4-3 145,000 SCHOOL TAXABLE VALUE

145,000

71 Smith Ave

Fm#5196Ⴭ Bla997/169 FD122 Mdltwn-hrdbrgh fd

145,000 TO

Kingston, NY 12401 ACRES 23.97

EAST-0444543 NRTH-1224154

DEED BOOK 1024 PG-138

FULL MARKET VALUE

145,000

******************************************************************************************************* 261.-3-1.112 ***************

County Hwy 6

07800339001

261.-3-1.112

120 Field crops

CO AG DIST 41720 0 81,400 81,400 81,400

Lipko Victor

Margaretville 124601 165,600 COUNTY TAXABLE VALUE

84,200

65 Central Park W Apt 11F New Kingston Tract 165,600 TOWN TAXABLE VALUE

84,200

New York, NY 10023 Wm A Crawford Jr

SCHOOL TAXABLE VALUE

84,200

ACRES 62.56

FD122 Mdltwn-hrdbrgh fd

165,600 TO

MAY BE SUBJECT TO PAYMENT EAST-0445047 NRTH-1225479

UNDER AGDIST LAW TIL 2020 DEED BOOK 906 PG-275

FULL MARKET VALUE

165,600

************************************************************************************************************************************