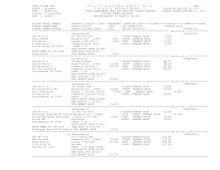

STATE OF NEW YORK

2 0 1 6 F I N A L A S S E S S M E N T R O L L

PAGE 360

COUNTY - Delaware

T A X A B L E SECTION OF THE ROLL - 1

VALUATION DATE-JUL 01, 2015

TOWN - Middletown

TAXABLE STATUS DATE-MAR 01, 2016

SWIS - 124689

TAX MAP NUMBER SEQUENCE

UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL

CURRENT OWNERS NAME SCHOOL DISTRICT

LAND TAX DESCRIPTION

TAXABLE VALUE

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS

ACCOUNT NO.

******************************************************************************************************* 243.-2-15 ******************

Dimmick Mt Rd

07800415026

243.-2-15

314 Rural vac<10

COUNTY TAXABLE VALUE

23,000

Covello Domenick

Margaretville 124601 23,000 TOWN TAXABLE VALUE

23,000

Mazzarella Walter Armstrong 3000 Lot 2 23,000 SCHOOL TAXABLE VALUE

23,000

PO Box 119

Kelly

FD123 Middletown fd #1

23,000 TO

Shokan, NY 12481

ACRES 2.74

EAST-0477370 NRTH-1227100

DEED BOOK 693 PG-153

FULL MARKET VALUE

23,000

******************************************************************************************************* 243.-2-16 ******************

Off County Hwy 36

07801014026

243.-2-16

210 1 Family Res

COUNTY TAXABLE VALUE

127,700

Voutsinas Gerasimos Roxbury 124802 53,800 TOWN TAXABLE VALUE

127,700

1922 Midlane Rd

Armstrong 3000 Lot 10 127,700 SCHOOL TAXABLE VALUE

127,700

Syosset, NY 11791 Voutsinas FM#9376

FD122 Mdltwn-hrdbrgh fd

127,700 TO

ACRES 8.83

EAST-0472208 NRTH-1225935

DEED BOOK 1150 PG-220

FULL MARKET VALUE

127,700

******************************************************************************************************* 243.-2-17 ******************

1817 County Hwy 36

07801785026

243.-2-17

260 Seasonal res

COUNTY TAXABLE VALUE

55,700

Bookless Elizabeth Lynne Roxbury

124802 45,500 TOWN TAXABLE VALUE

55,700

1817 County Hwy 36 Armstrong 3000 L-10-C 55,700 SCHOOL TAXABLE VALUE

55,700

Margaretville, NY 12455 ACRES 9.40

FD122 Mdltwn-hrdbrgh fd

55,700 TO

EAST-0472340 NRTH-1226293

DEED BOOK 711 PG-930

FULL MARKET VALUE

55,700

******************************************************************************************************* 243.-2-18.1 ****************

1932 County Hwy 36

07801463026

243.-2-18.1

210 1 Family Res

COUNTY TAXABLE VALUE

127,400

Young Gary Allan

Roxbury 124802 19,700 TOWN TAXABLE VALUE

127,400

515 E 83rd St Apt 3B Armstrong 3000 Lot 10 127,400 SCHOOL TAXABLE VALUE

127,400

New York, NY 10028-7263 Finley Est

FD122 Mdltwn-hrdbrgh fd

127,400 TO

ACRES 0.77

EAST-0471105 NRTH-1225935

DEED BOOK 1366 PG-60

FULL MARKET VALUE

127,400

******************************************************************************************************* 243.-2-18.2 ****************

1950 County Hwy 36

07835468126

243.-2-18.2

270 Mfg housing

COUNTY TAXABLE VALUE

51,700

Young Gary Allan

Roxbury 124802 14,600 TOWN TAXABLE VALUE

51,700

515 E 83rd St Apt 3B Armstrong 3000 A Gl40 51,700 SCHOOL TAXABLE VALUE

51,700

New York, NY 10028-7263 Finley Est

FD122 Mdltwn-hrdbrgh fd

51,700 TO

FRNT 145.00 DPTH 72.00

ACRES 0.27

EAST-0471145 NRTH-1226103

DEED BOOK 1366 PG-60

FULL MARKET VALUE

51,700

************************************************************************************************************************************