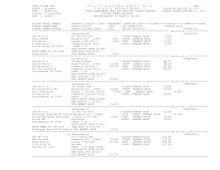

STATE OF NEW YORK

2 0 1 6 F I N A L A S S E S S M E N T R O L L

PAGE 662

COUNTY - Delaware

T A X A B L E SECTION OF THE ROLL - 1

VALUATION DATE-JUL 01, 2015

TOWN - Middletown

TAXABLE STATUS DATE-MAR 01, 2016

SWIS - 124689

TAX MAP NUMBER SEQUENCE

UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL

CURRENT OWNERS NAME SCHOOL DISTRICT

LAND TAX DESCRIPTION

TAXABLE VALUE

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS

ACCOUNT NO.

******************************************************************************************************* 287.-5-28 ******************

832 Wood Rd

07892208601

287.-5-28

210 1 Family Res

COUNTY TAXABLE VALUE

195,300

Fonseca Joseph

Margaretville 124601 46,000 TOWN TAXABLE VALUE

195,300

Outwater Sarah

Armstrong L-38#3435#10 195,300 SCHOOL TAXABLE VALUE

195,300

46 Richmond Ave

Niebanck

FD123 Middletown fd #1

195,300 TO

Cranford, NJ 07016 ACRES 5.01 BANK 11

EAST-0488397 NRTH-1211474

DEED BOOK 1385 PG-275

FULL MARKET VALUE

195,300

******************************************************************************************************* 287.-5-29 ******************

906 Wood Rd

07892218601

287.-5-29

210 1 Family Res

COUNTY TAXABLE VALUE

204,600

Warnock Robert W

Margaretville 124601 53,100 TOWN TAXABLE VALUE

204,600

Warnock Patricia

Armstrong L-38#3435#11 204,600 SCHOOL TAXABLE VALUE

204,600

518 Eder Ave

Beaverdam Associates

FD123 Middletown fd #1

204,600 TO

Wyckoff, NJ 07481 ACRES 6.96

EAST-0488197 NRTH-1210887

DEED BOOK 664 PG-685

FULL MARKET VALUE

204,600

******************************************************************************************************* 287.-5-30 ******************

Wood Rd

07892228601

287.-5-30

314 Rural vac<10

COUNTY TAXABLE VALUE

36,300

Desic Jasmin

Margaretville 124601 36,300 TOWN TAXABLE VALUE

36,300

Desic Sabina

Armstrong L-38#3435#12 36,300 SCHOOL TAXABLE VALUE

36,300

PO Box 125

Shallis Trust

FD123 Middletown fd #1

36,300 TO

Fleischmanns, NY 12430 ACRES 5.08

EAST-0488628 NRTH-1210761

DEED BOOK 1469 PG-318

FULL MARKET VALUE

36,300

******************************************************************************************************* 287.-5-31 ******************

1090-1092 Wood Rd

07892238601

287.-5-31

215 1 Fam Res w/

COUNTY TAXABLE VALUE

595,900

Brumm Nicholas D S Margaretville 124601 81,200 TOWN TAXABLE VALUE

595,900

Patel Shyama

Armstrong L-38#3435#13 595,900 SCHOOL TAXABLE VALUE

595,900

1 Lexington Ave Apt 7A Smith

FD123 Middletown fd #1

595,900 TO

New York, NY 10010 ACRES 5.46

EAST-0488725 NRTH-1210345

DEED BOOK 992 PG-167

FULL MARKET VALUE

595,900

******************************************************************************************************* 287.-5-32 ******************

Brush Ridge Rd

07892248601

287.-5-32

322 Rural vac>10

COUNTY TAXABLE VALUE

66,200

Brumm Nicholas D S Margaretville 124601 66,200 TOWN TAXABLE VALUE

66,200

Patel Shyama

Armstrong L-38#3435#15 66,200 SCHOOL TAXABLE VALUE

66,200

1 Lexington Ave Apt 7A Smith

FD123 Middletown fd #1

66,200 TO

New York, NY 10010 ACRES 13.67

EAST-0488331 NRTH-1209975

DEED BOOK 992 PG-167

FULL MARKET VALUE

66,200

************************************************************************************************************************************