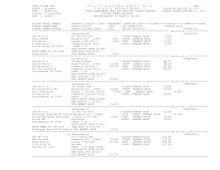

STATE OF NEW YORK

2 0 1 6 F I N A L A S S E S S M E N T R O L L

PAGE 555

COUNTY - Delaware

T A X A B L E SECTION OF THE ROLL - 1

VALUATION DATE-JUL 01, 2015

TOWN - Middletown

TAXABLE STATUS DATE-MAR 01, 2016

SWIS - 124689

TAX MAP NUMBER SEQUENCE

UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL

CURRENT OWNERS NAME SCHOOL DISTRICT

LAND TAX DESCRIPTION

TAXABLE VALUE

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS

ACCOUNT NO.

******************************************************************************************************* 285.-1-34.2 ****************

337 Searles Rd

07800045001

285.-1-34.2

270 Mfg housing

CW_15_VET/ 41163 0

0 12,000

0

Archibald Carol F Margaretville 124601 45,100 STAR ENHAN 41834 0

0 0 65,300

Archibald Jeffrey M Lewis Tl132fm#6695&6773 128,700 COUNTY TAXABLE VALUE

128,700

337 Searles Rd

Archibald

TOWN TAXABLE VALUE

116,700

Margaretville, NY 12455 ACRES 6.41

SCHOOL TAXABLE VALUE

63,400

EAST-0456043 NRTH-1211029 FD122 Mdltwn-hrdbrgh fd

128,700 TO

DEED BOOK 1363 PG-253

FULL MARKET VALUE

128,700

******************************************************************************************************* 285.-1-35 ******************

401 Searles Rd

07801676001

285.-1-35

210 1 Family Res

STAR ENHAN 41834 0

0 0 65,300

Daniels Loren

Margaretville 124601 58,800 COUNTY TAXABLE VALUE

190,800

Daniels Susan

M Lewis Gl#40 L132fm#6773 190,800 TOWN TAXABLE VALUE

190,800

496 Tilden Ave

Braton

SCHOOL TAXABLE VALUE

125,500

Teaneck, NJ 07666 ACRES 8.00

FD122 Mdltwn-hrdbrgh fd

190,800 TO

EAST-0456083 NRTH-1211693

PRIOR OWNER ON 3/01/2016 DEED BOOK 1484 PG-276

Daniels Loren

FULL MARKET VALUE

190,800

******************************************************************************************************* 285.-1-37 ******************

Searles Rd

07800101001

285.-1-37

210 1 Family Res

COUNTY TAXABLE VALUE

109,500

Burke William

Margaretville 124601 37,600 TOWN TAXABLE VALUE

109,500

Burke Eunice

M Lewis Gl40 Lot 132 109,500 SCHOOL TAXABLE VALUE

109,500

15 Mayflower Ct

Burke

FD122 Mdltwn-hrdbrgh fd

109,500 TO

Freeport, NY 11520 ACRES 4.40

EAST-0456129 NRTH-1212657

DEED BOOK 1392 PG-240

FULL MARKET VALUE

109,500

******************************************************************************************************* 285.-1-38 ******************

778-780 Searles Rd

07801424001

285.-1-38

250 Estate

COUNTY TAXABLE VALUE

607,700

Oppenheimer Tom

Margaretville 124601 235,500 TOWN TAXABLE VALUE

607,700

410 Dogwood Ct

M Lewis Lot 133-134 607,700 SCHOOL TAXABLE VALUE

607,700

Norwood, NJ 07648 Marx

FD122 Mdltwn-hrdbrgh fd

607,700 TO

ACRES 103.50

EAST-0457816 NRTH-1213863

DEED BOOK 744 PG-392

FULL MARKET VALUE

607,700

******************************************************************************************************* 285.-1-39.1 ****************

Hidden Waters Dr

07800945001

285.-1-39.1

322 Rural vac>10

COUNTY TAXABLE VALUE

884,000

City of New York

Margaretville 124601 884,000 TOWN TAXABLE VALUE

884,000

Bureau of Water Supply, Taxes Ep Liv L1-9-10 FM#8715

884,000 SCHOOL TAXABLE VALUE

884,000

71 Smith Ave

You-Ing USA INC

FD122 Mdltwn-hrdbrgh fd

884,000 TO

Kingston, NY 12401 ACRES 206.52

EAST-0458037 NRTH-1216044

DEED BOOK 1301 PG-201

FULL MARKET VALUE

884,000

************************************************************************************************************************************