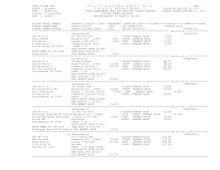

STATE OF NEW YORK

2 0 1 6 F I N A L A S S E S S M E N T R O L L

PAGE 521

COUNTY - Delaware

T A X A B L E SECTION OF THE ROLL - 1

VALUATION DATE-JUL 01, 2015

TOWN - Middletown

TAXABLE STATUS DATE-MAR 01, 2016

SWIS - 124689

TAX MAP NUMBER SEQUENCE

UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL

CURRENT OWNERS NAME SCHOOL DISTRICT

LAND TAX DESCRIPTION

TAXABLE VALUE

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS

ACCOUNT NO.

******************************************************************************************************* 284.-1-17.2 ****************

585 Cemetery Rd

07813047801

284.-1-17.2

210 1 Family Res

ELG VET C 41102 0 5,000 0

0

Tweedie Ronald L

Margaretville 124601 26,200 VET COM T 41133 0

0 20,000

0

Tweedie Kathleen

M Lewis Gl39 FM#9568 143,900 STAR ENHAN 41834 0

0 0 65,300

585 Cemetery Rd

Tweedie

COUNTY TAXABLE VALUE

138,900

Margaretville, NY 12455 ACRES 1.70

TOWN TAXABLE VALUE

123,900

EAST-0455978 NRTH-1209491 SCHOOL TAXABLE VALUE

78,600

DEED BOOK 575 PG-851

FD122 Mdltwn-hrdbrgh fd

143,900 TO

FULL MARKET VALUE

143,900

******************************************************************************************************* 284.-1-19 ******************

42679 State Hwy 30

07801422001

284.-1-19

283 Res w/Comuse

STAR BASIC 41854 0

0 0 30,000

Ondish John Michael Margaretville 124601 30,500 COUNTY TAXABLE VALUE

198,800

42679 State Hwy 30 M Lewis Gl#39

198,800 TOWN TAXABLE VALUE

198,800

Margaretville, NY 12455 Ondish Est

SCHOOL TAXABLE VALUE

168,800

ACRES 1.10

FD122 Mdltwn-hrdbrgh fd

198,800 TO

EAST-0456315 NRTH-1208676

DEED BOOK 1153 PG-8

FULL MARKET VALUE

198,800

******************************************************************************************************* 284.-1-20 ******************

42565 State Hwy 28

07801223001

284.-1-20

552 Golf course

COUNTY TAXABLE VALUE

206,400

Matson Russel

Margaretville 124601 174,400 TOWN TAXABLE VALUE

206,400

Hernandez Julie V Meinstein

206,400 SCHOOL TAXABLE VALUE

206,400

PO Box 1120

ACRES 22.73

FD121 Arkville fire dist 206,400 TO

Margaretville, NY 12455 EAST-0456649 NRTH-1207694 LT419 Arkville light

206,400 TO

DEED BOOK 946 PG-54

FULL MARKET VALUE

206,400

******************************************************************************************************* 284.-1-21 ******************

State Hwy 30

07800371001

284.-1-21

105 Vac farmland

CO AG DIST 41720 0 56,900 56,900 56,900

Davis Holding CO LLC Margaretville 124601 155,000 COUNTY TAXABLE VALUE

98,100

PO Box 192

M Lewis Gl39 Lot 138 155,000 TOWN TAXABLE VALUE

98,100

Margaretville, NY 12455 Davis

SCHOOL TAXABLE VALUE

98,100

ACRES 55.00

FD122 Mdltwn-hrdbrgh fd

155,000 TO

MAY BE SUBJECT TO PAYMENT EAST-0455443 NRTH-1207824

UNDER AGDIST LAW TIL 2020 DEED BOOK 786 PG-98

FULL MARKET VALUE

155,000

******************************************************************************************************* 284.-1-22 ******************

42533 State Hwy 30

07800430001

284.-1-22

210 1 Family Res

AGED C/S 41805 0 30,810 0 30,810

Dobsa Gary K

Margaretville 124601 16,300 STAR ENHAN 41834 0

0 0 65,300

42533 State Hwy 30 M Lewis Gl#39

102,700 COUNTY TAXABLE VALUE

71,890

Margaretville, NY 12455 Dobsa

TOWN TAXABLE VALUE

102,700

FRNT 209.00 DPTH 165.00 SCHOOL TAXABLE VALUE

6,590

ACRES 0.44

FD122 Mdltwn-hrdbrgh fd

102,700 TO

EAST-0455583 NRTH-1208641

DEED BOOK 1051 PG-217

FULL MARKET VALUE

102,700

************************************************************************************************************************************