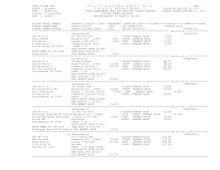

STATE OF NEW YORK

2 0 1 6 F I N A L A S S E S S M E N T R O L L

PAGE 466

COUNTY - Delaware

T A X A B L E SECTION OF THE ROLL - 1

VALUATION DATE-JUL 01, 2015

TOWN - Middletown

TAXABLE STATUS DATE-MAR 01, 2016

SWIS - 124689

TAX MAP NUMBER SEQUENCE

UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL

CURRENT OWNERS NAME SCHOOL DISTRICT

LAND TAX DESCRIPTION

TAXABLE VALUE

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS

ACCOUNT NO.

******************************************************************************************************* 264.-2-1 *******************

15 Hog Mt Spur

07801974001

264.-2-1

210 1 Family Res

CW_15_VET/ 41163 0

0 12,000

0

McLear John W

Roxbury 124802 16,900 STAR ENHAN 41834 0

0 0 65,300

Angiolelli June C Armstrong 3000 Lot 7 106,000 COUNTY TAXABLE VALUE

106,000

15 Hog Mt Spur

McLear&Angiolelli

TOWN TAXABLE VALUE

94,000

Margaretville, NY 12455 ACRES 0.50

SCHOOL TAXABLE VALUE

40,700

EAST-0468615 NRTH-1220376 FD122 Mdltwn-hrdbrgh fd

106,000 TO

DEED BOOK 1412 PG-57

FULL MARKET VALUE

106,000

******************************************************************************************************* 264.-2-2 *******************

Hog Mt Spur

07802112001

264.-2-2

314 Rural vac<10

COUNTY TAXABLE VALUE

34,300

Humphrey-Skomer Jael Roxbury 124802 34,300 TOWN TAXABLE VALUE

34,300

Goldenstein Crystal Armstrong 3000 Lot 7 34,300 SCHOOL TAXABLE VALUE

34,300

772 Lafayette Ave Johnson

FD122 Mdltwn-hrdbrgh fd

34,300 TO

Brooklyn, NY 11221 ACRES 6.70

EAST-0469020 NRTH-1220242

PRIOR OWNER ON 3/01/2016 DEED BOOK 1477 PG-49

Humphrey-Skomer Jael FULL MARKET VALUE

34,300

******************************************************************************************************* 264.-2-3 *******************

426 Cornelius Rd

07800825026

264.-2-3

210 1 Family Res

COUNTY TAXABLE VALUE

133,700

Bradshaw Jack F

Roxbury 124802 51,400 TOWN TAXABLE VALUE

133,700

Barham Joanne E

Armstrong 3000 Lot 7 133,700 SCHOOL TAXABLE VALUE

133,700

140 Cabrini Blvd Apt 102 Plante

FD122 Mdltwn-hrdbrgh fd

133,700 TO

New York, NY 10033 ACRES 8.17

EAST-0469371 NRTH-1220087

DEED BOOK 1141 PG-234

FULL MARKET VALUE

133,700

******************************************************************************************************* 264.-2-4 *******************

35 Hog Mt Spur

07802112101

264.-2-4

210 1 Family Res

COUNTY TAXABLE VALUE

224,900

Humphrey-Skomer Jael Roxbury 124802 28,800 TOWN TAXABLE VALUE

224,900

Goldenstein Crystal Armstrong 3000 Lot 7 224,900 SCHOOL TAXABLE VALUE

224,900

772 Lafayette Ave Johnson

FD122 Mdltwn-hrdbrgh fd

224,900 TO

Brooklyn, NY 11221 ACRES 3.00

EAST-0468933 NRTH-1220756

PRIOR OWNER ON 3/01/2016 DEED BOOK 1477 PG-49

Humphrey-Skomer Jael FULL MARKET VALUE

224,900

******************************************************************************************************* 264.-2-5 *******************

476 Cornelius Rd

07800409026

264.-2-5

240 Rural res

COUNTY TAXABLE VALUE

325,700

Wugalter Fred

Roxbury 124802 65,400 TOWN TAXABLE VALUE

325,700

8115 Princess Palm Cir Armstrong 3000 L-7-6 325,700 SCHOOL TAXABLE VALUE

325,700

Tamarac, FL 33321 ACRES 12.30

FD122 Mdltwn-hrdbrgh fd

325,700 TO

EAST-0469858 NRTH-1220367

DEED BOOK 720 PG-319

FULL MARKET VALUE

325,700

************************************************************************************************************************************