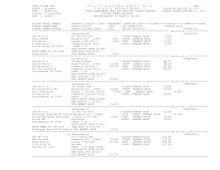

STATE OF NEW YORK

2 0 1 6 F I N A L A S S E S S M E N T R O L L

PAGE 400

COUNTY - Delaware

T A X A B L E SECTION OF THE ROLL - 1

VALUATION DATE-JUL 01, 2015

TOWN - Middletown

TAXABLE STATUS DATE-MAR 01, 2016

SWIS - 124689

TAX MAP NUMBER SEQUENCE

UNIFORM PERCENT OF VALUE IS 100.00

TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOL

CURRENT OWNERS NAME SCHOOL DISTRICT

LAND TAX DESCRIPTION

TAXABLE VALUE

CURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS

ACCOUNT NO.

******************************************************************************************************* 262.-3-1.3 *****************

Piacquadio Rd

262.-3-1.3

314 Rural vac<10

COUNTY TAXABLE VALUE

33,600

Commisso George

Margaretville 124601 33,600 TOWN TAXABLE VALUE

33,600

Commisso Marietta Toma

33,600 SCHOOL TAXABLE VALUE

33,600

248 Grand Ave

ACRES 5.44

FD122 Mdltwn-hrdbrgh fd

33,600 TO

Lindenhurst, NY 11757 EAST-0455784 NRTH-1219918

DEED BOOK 1073 PG-292

FULL MARKET VALUE

33,600

******************************************************************************************************* 262.-3-2 *******************

240 Piacquadio Rd

07800050001

262.-3-2

210 1 Family Res

COUNTY TAXABLE VALUE

127,000

DelSignore Sereno Margaretville 124601 25,300 TOWN TAXABLE VALUE

127,000

DelSignore Elisabetta Ep Livingston Lot 12 127,000 SCHOOL TAXABLE VALUE

127,000

39-65 52nd St Apt 11K Genova

FD122 Mdltwn-hrdbrgh fd

127,000 TO

Woodside, NY 11377 ACRES 1.55

EAST-0456364 NRTH-1218968

DEED BOOK 748 PG-911

FULL MARKET VALUE

127,000

******************************************************************************************************* 262.-3-3 *******************

366 Piacquadio Rd

07803667701

262.-3-3

210 1 Family Res

COUNTY TAXABLE VALUE

131,900

Turek Christian

Margaretville 124601 28,200 TOWN TAXABLE VALUE

131,900

Turek Kathleen Loysen Ep Livingston Lot 12 131,900 SCHOOL TAXABLE VALUE

131,900

40 Fairfield St

Turek&Loysen

FD122 Mdltwn-hrdbrgh fd

131,900 TO

Montclair, NJ 07042 ACRES 2.06

EAST-0455860 NRTH-1218943

DEED BOOK 1408 PG-136

FULL MARKET VALUE

131,900

******************************************************************************************************* 262.-3-4 *******************

502 Piacquadio Rd

07811767801

262.-3-4

210 1 Family Res

COUNTY TAXABLE VALUE

128,300

Duggan Robert M

Margaretville 124601 34,200 TOWN TAXABLE VALUE

128,300

Duggan Luiza

Ep Livingston Lot 12 128,300 SCHOOL TAXABLE VALUE

128,300

1075 Harrow Rd

ONeil

FD122 Mdltwn-hrdbrgh fd

128,300 TO

Franklin Square, NY 11010 ACRES 3.54

EAST-0455640 NRTH-1219525

DEED BOOK 1284 PG-290

FULL MARKET VALUE

128,300

******************************************************************************************************* 262.-3-5 *******************

1225 W Hubbell Hill Rd

07830428001

262.-3-5

240 Rural res

COUNTY TAXABLE VALUE

206,800

Giletto John

Margaretville 124601 68,000 TOWN TAXABLE VALUE

206,800

Giletto Lizbeth

Ep Livingston L-12 206,800 SCHOOL TAXABLE VALUE

206,800

484 W 43rd St Apt 18N DeLuca

FD122 Mdltwn-hrdbrgh fd

206,800 TO

New York, NY 10036 ACRES 10.64 BANK 4333

EAST-0457288 NRTH-1218455

DEED BOOK 1127 PG-233

FULL MARKET VALUE

206,800

************************************************************************************************************************************